Increasing numbers of businesses need to perform Identity Verification (IDv) on clients to comply with legislation such as Anti Money Laundering, Know Your Customer and Right to Work.

Historically, this relied on using data bureaus to cross-reference personal data with manual ID document checks. Often, this time-consuming, offline process, resulted in merely photocopying an ID document. This presented challenges for Data Protection compliance and could be unreliable as, in practice, most people involved are not experts and struggle to spot forgeries. This is where emerging technology like facial recognition and document authentication can help.

Cutting-edge technology

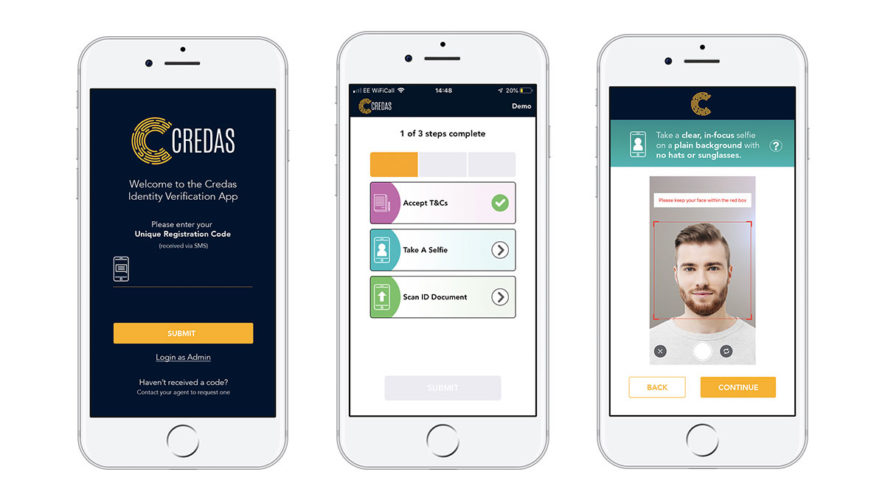

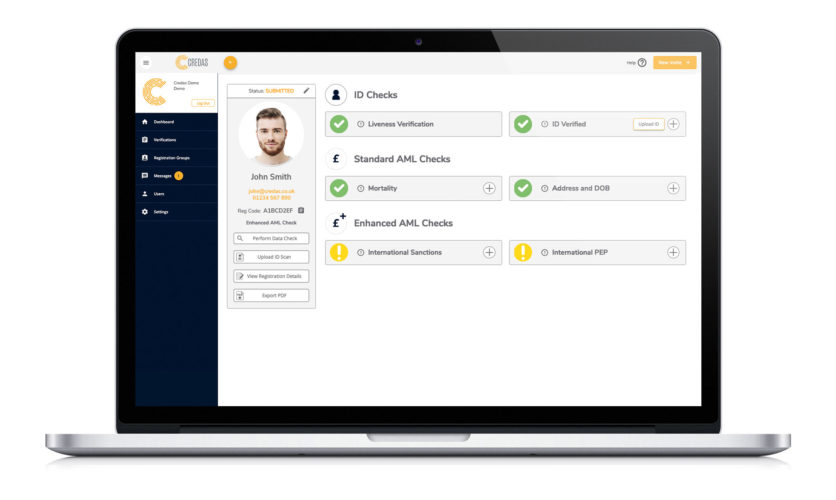

Credas, based in Penarth in the Vale of Glamorgan, has developed a solution to revolutionise this process through cutting-edge tech that ensures that the person being checked is ‘real and present’ and matches the image in the document. The technology also provides real-time document verification using either a mobile app or browser-based solution.

Within seconds, Credas can scan and verify over 4,000 types of documents – analysing the document image, using Optical Character Recognition and confirming that the information on the document is correct and unadulterated.

The Near Field Communication solution also reads the biometric chips on passports and extracts all critical information as well as the portrait image of the passport holder which we automatically verify using a leading 72 point check.

Remote and reliable

This powerful combination of technologies is served through smooth and secure user experience and is designed to help users through the IDv process quickly and painlessly. Crucially, the process can happen remotely, avoiding the need to bring documents into local branches or send them through the post.

Confidence in compliance

Our products have been shaped by legislation and developed iteratively by responding to customer feedback and the ever-changing needs of the regulatory compliance landscape.

We’ve helped hundreds of businesses to automate and streamline their IDv checks, saving many business hours while increasing accuracy, ensuring Data Protection compliance and providing improved customer engagement experiences.

Department for Culture, Media and Sport

Department for Culture, Media and Sport